Tax Consultancy

(Professional advice for your business)

Direct and Indirect Taxation

Taxation & GST Services

Expert Taxation Solutions for Businesses & Individuals

At J M A & Co., we provide comprehensive taxation and GST advisory services tailored to meet the dynamic needs of businesses and individuals. Our expertise ensures compliance, efficiency, and strategic tax planning to help you optimize your tax liabilities while adhering to legal frameworks.

Our Taxation Services

1. Income Tax Advisory & Compliance

- Tax return preparation and filing for individuals, firms, and companies

- Tax planning strategies to minimize liabilities

- Handling notices, assessments, and appeals

- TDS/TCS compliance and return filing

2. Corporate & Business Taxation

- Corporate tax planning and compliance

- Advance tax computation and filing

- Representation before tax authorities

- Tax audits as per statutory requirements

GST Services – Ensuring Seamless Compliance

1. GST Registration & Compliance

- GST registration for businesses, startups, and professionals

- Periodic GST return filing (GSTR-1, GSTR-3B, GSTR-9, etc.)

- E-invoicing and E-way bill compliance

2. GST Advisory & Litigation Support

- GST input tax credit (ITC) optimization

- GST impact analysis on transactions and pricing

- Handling GST audits, scrutiny, and notices

- Representation before GST authorities

Why Choose J M A & Co.?

- Experienced Chartered Accountants & Tax Professionals

- Timely and accurate tax compliance

- Strategic tax-saving solutions

- Personalized client support and representation

GST Consulting & Implementation

At J M A & Co., we provide expert GST Consulting and Implementation services designed to help businesses navigate the complexities of GST and related tax systems. Our goal is to enable businesses to operate in the most tax-efficient manner while ensuring full compliance with local and international tax regulations.

Our GST Consulting Services

- GST Impact Assessment: Analyze the effect of GST on your business operations and financial performance while identifying opportunities for optimization.

- Tax-Efficient Business Structuring: Design a structure that maximizes Input GST utilization and ensures timely refunds, in compliance with Federal Tax Authorities (FTA).

- Compliance with Local and International Tax Laws: Provide guidance on local and international tax regulations, including GST, Excise Tax, and other indirect taxes.

- Implementation and Ongoing Support: Assist with GST system implementation, filing, reporting, and ongoing regulatory updates.

Key Features of Our GST Services

- Utilization and Refund of Input GST: Ensure your business fully leverages Input GST credits and receives timely refunds to enhance cash flow.

- Guidance on Tax Regulations: Stay updated with the latest changes in GST, Excise Tax, and indirect tax laws across various jurisdictions.

Benefits of Partnering with J M A & Co.

- Tax Efficiency: Minimize tax liabilities and improve cash flow through effective GST management.

- Regulatory Compliance: Ensure full compliance with Federal Tax Authority (FTA) requirements and local tax laws.

- Customized Solutions: Tailor tax strategies to your business needs and industry requirements.

- Global Expertise: Leverage our extensive knowledge of international taxation and indirect tax regulations to support cross-border operations.

- Proactive Support: Stay ahead of regulatory changes with timely updates and expert guidance.

At J M A & Co., we are committed to simplifying the complexities of GST and indirect taxes for your business, ensuring compliance while optimizing tax efficiency and operational performance.

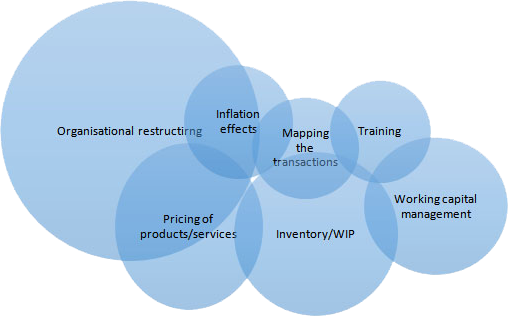

Impact of GST on your business

How We Help You Devise a GST Plan

At J M A & Co., we specialize in creating tailored GST plans that address your business’s unique needs and ensure seamless compliance with GST laws. Our process is structured to help your organization effectively manage GST-related challenges while optimizing tax efficiency and maintaining compliance.

1. Business Structure Analysis

- Conduct a comprehensive review of your company’s existing business structure.

- Identify aspects of the business that may be impacted by GST laws, including procurement, supply chain, invoicing, and pricing strategies.

2. Classification and Segregation of Transactions

- Categorize your company’s operations into local, interstate, and foreign transactions.

- Evaluate the GST implications of each type of transaction to provide clarity and actionable insights.

- Review existing contracts to ensure they align with GST requirements and provide recommendations for amendments where necessary.

- Assist in recovering Input Tax Credits by ensuring proper documentation and compliance with recovery rules.

3. GST Registration Assistance

- Guide your company in understanding the mandatory and voluntary registration requirements under GST law.

- Assist in preparing and submitting the documents required for registration to obtain a GST Registration Number.

- Provide clarifications and submit additional documentation as requested by GST authorities during the registration process.

4. GST Software Review and Optimization

- Review OUTPUT and INPUT data from your implemented GST software to ensure accuracy and compliance.

- Suggest modifications or improvements in the software configuration to meet regulatory requirements and optimize tax management.

5. GST Compliance and Tax Returns

- Assist in the preparation and submission of GST-compliant tax returns, including GSTR-1, GSTR-3B, and others as applicable.

- Ensure accurate and timely filing of returns to avoid penalties and maintain compliance.

- Provide ongoing support to address compliance issues and manage any queries raised by authorities.

At J M A & Co., we are committed to helping your business navigate GST complexities effectively while optimizing operational efficiency and tax benefits.

GST: Some Key Highlights

What is GST in India?

The Goods and Services Tax (GST) is a comprehensive, destination-based indirect tax system that has replaced many indirect taxes in India, such as excise duty, VAT, and service tax. GST was implemented on 1st July 2017, following the passage of the GST Act in Parliament on 29th March 2017.

GST is levied on the supply of goods and services at every stage of the supply chain, ensuring uniform taxation across the country. It simplifies India’s indirect tax system by consolidating multiple taxes into a single law.

Key Features of GST

1. Multi-Stage Tax

GST is applied at every stage of the supply chain, from the purchase of raw materials to the final sale to the consumer.

- Purchase of raw materials

- Production or manufacturing process

- Warehousing of finished goods

- Selling to wholesalers

- Sale of products to retailers

- Final sale to end consumers

2. Value Addition

GST is levied only on the monetary value added at each stage of the supply chain.

- Example: A biscuit manufacturer buys raw materials like flour and sugar, converts them into biscuits, and sells them to a warehousing agent who packages them. Each stage adds value to the product, and GST is charged only on the value addition at each stage.

3. Destination-Based Tax

GST is collected at the point of consumption, not origin.

- Example: If goods are manufactured in Punjab and sold to a consumer in Himachal Pradesh, the tax revenue will go to Himachal Pradesh, the place of consumption.

Benefits of GST

- Eliminates cascading taxes by allowing input tax credits.

- Creates a uniform tax structure across the country.

- Simplifies compliance by consolidating multiple taxes.

- Encourages formalization of the economy.

- Boosts economic growth by streamlining taxation.

We are Chartered Accountants

> Your Business Consultant <

Specialize in helping small and medium-sized enterprises (SMEs) create sustainable growth through successful expansion into international markets.

Download Firm Profile